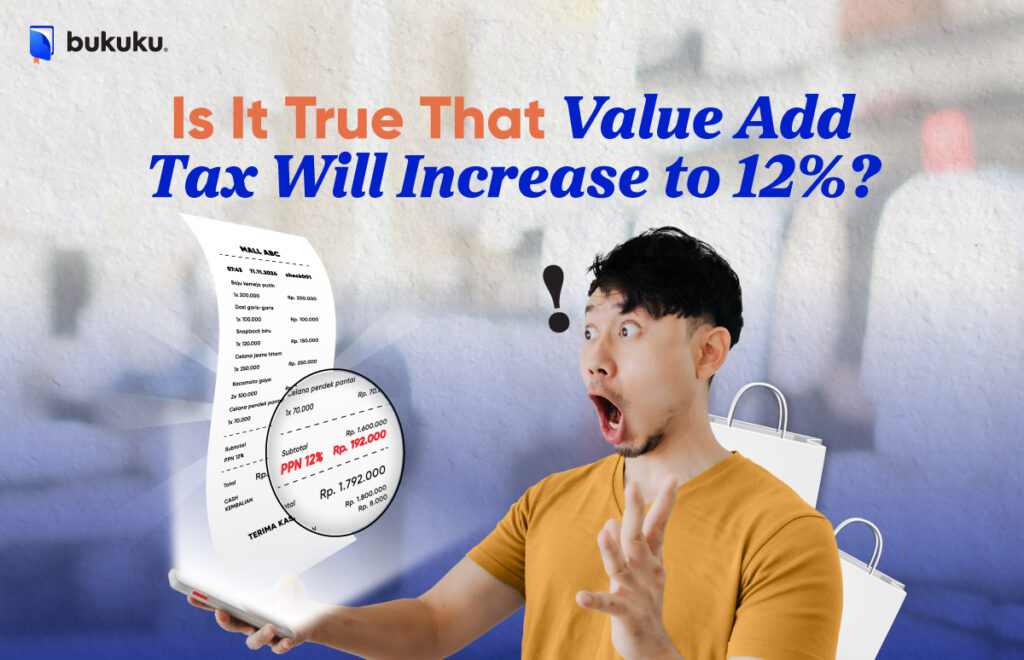

Is It True That Value Add Tax will increase to 12%?

Value Added Tax (PPN) is one of the important components of the tax system in Indonesia. Recently, there has been much discussion regarding the planned increase in PPN rates. Have you heard this news? Let’s take a closer look at the facts behind this issue.

According to official information from the Ministry of Economy of the Republic of Indonesia, PPN will indeed increase by 1%. Therefore, the current PPN rate will rise to 12% starting January 1, 2025. This is a step taken by the government to enhance state revenue, and it is important for us to pay close attention to it.

So, what is the reason behind this decision? According to the Coordinating Ministry for Economic Affairs, the adjustment of the PPN rate aims to optimize state revenue. However, this increase will still be accompanied by a fair and legally certain tax system. It is hoped that this will create a balance between state income and community welfare.

The increase in PPN will certainly impact many aspects. For instance, when you buy a new gadget, a vehicle, or even your favorite skincare products, all of these will be affected by the new rates. Therefore, it is important for us to better understand how these changes may influence our daily expenses.

Feel free to share this article with your colleagues and friends that PPN will indeed increase next year. Hopefully, this article is beneficial for you.

This article is based on written regulations: UNDANG-UNDANG REPUBLIK INDONESIA NOMOR 17 TAHUN 2021

TANGGAL 29 OKTOBER 2021