What to Do If Your Office Doesn’t Provide a Tax Withholding Receipt

Have you ever wondered, “Why hasn’t my office given me a tax withholding receipt? Is the withholding amount accurate?” If you haven’t received your tax withholding receipt from your employer, don’t worry—you can actually check it yourself!

Curious about how to do it? Let’s follow this simple tutorial together.

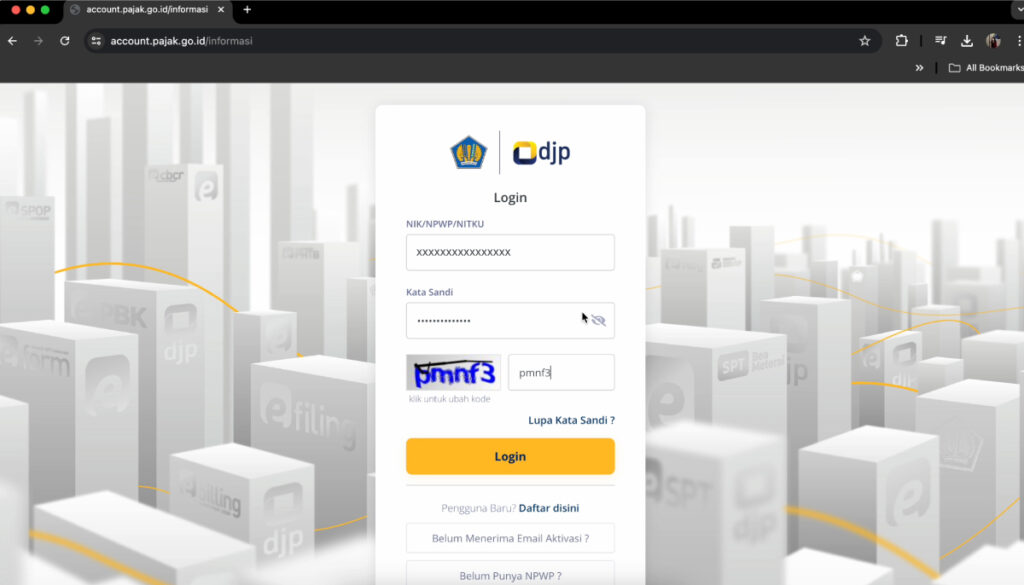

- Step 1: Access DJP Online

First, visit the official DJP Online website at pajak.go.id. Once there, log in using your NIK (National Identity Number) and NPWP (Tax Identification Number).

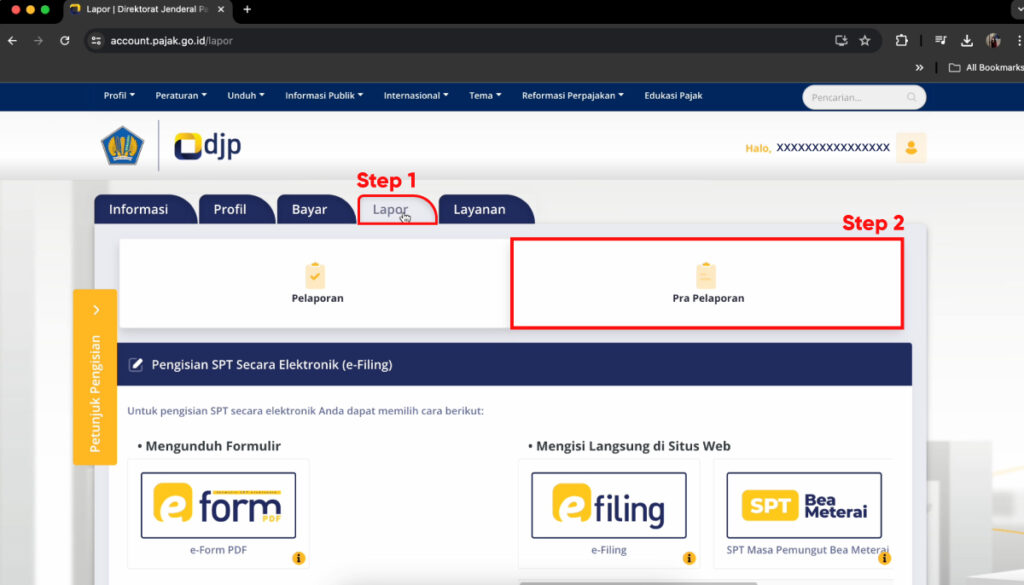

- Step 2: Go to the Reporting Menu

After logging in, you’ll arrive at the DJP Online homepage. Look for the “Lapor” (Report) menu and click on it.

- Step 3: Pre-Reporting Section

In the reporting menu, select the “Pra Pelaporan” (Pre-Reporting) section. Then, choose “E-Bupot Unifikasi” (Unified E-Withholding Receipt).

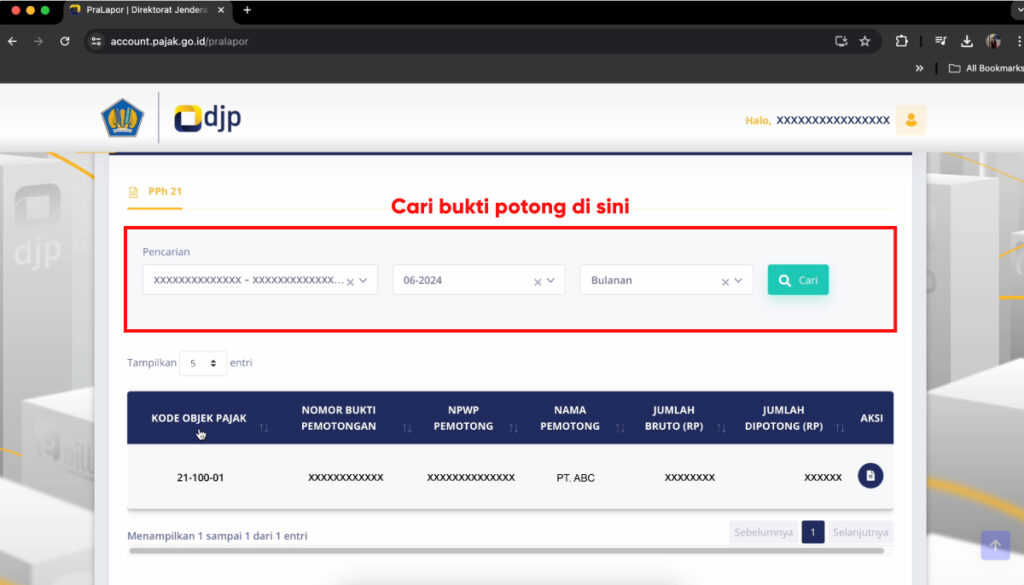

- Step 4: Search for Your Withholding Receipt

In the search column, adjust your identity details. You’ll need to select the relevant tax period or year and the type of withholding receipt. If you are currently employed, make sure to select the monthly option.

Once you’ve filled in the required information, you will see details such as the tax object code, withholding receipt number, the withholding NPWP, the name of the withholding agent, the gross amount, and the amount withheld. To access the details of your withholding receipt, click on the file icon in the action column. This will provide you with specific information about your receipt.

See? It’s really easy, isn’t it? With this service, you can verify whether the tax withholdings from your income are accurate, giving you peace of mind.

Download Bukuku Personal now on your phone and experience the ease of managing your finances!

This article is based on written regulations: PERATURAN DIREKTUR JENDERAL PAJAK

NOMOR PER-2/PJ/2024 TANGGAL 19 JANUARI 2024