Will Basic Necessities Be Subject to Value Add Tax? Check the Facts Here!

Recently, there has been a lot of discussion about the plan to impose a 1% Value Added Tax on nine essential goods. This news has understandably caused concern among the public, especially for those reliant on basic needs for daily life. However, before we panic, let’s take a closer look at the information surrounding this issue.

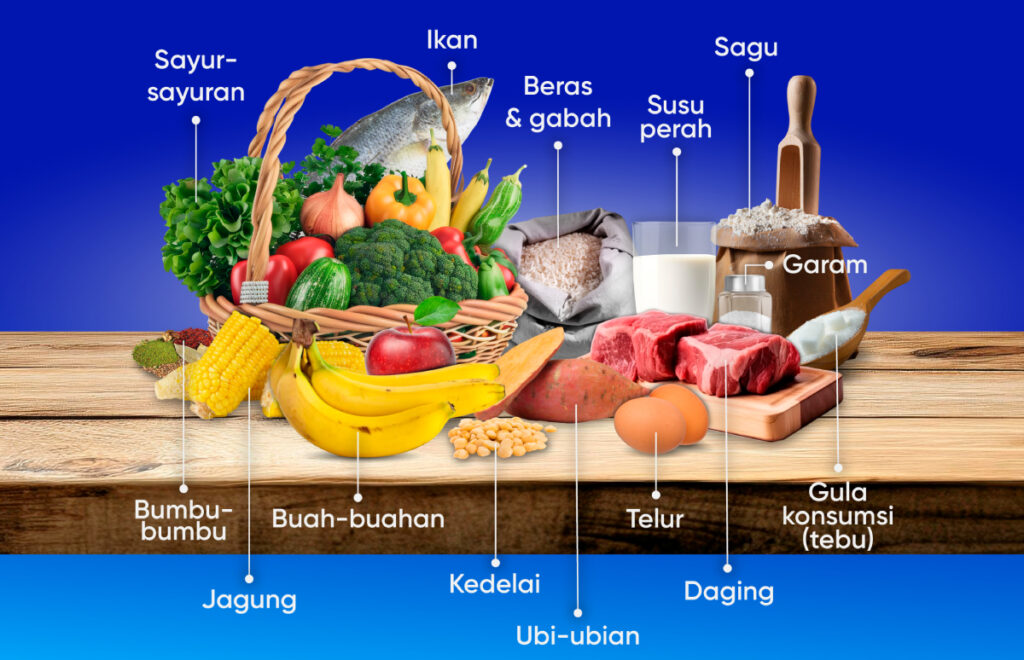

The Ministry of Finance of the Republic of Indonesia has clarified that this proposal is not accurate. So, dear readers, there’s no need to worry! The 1% value added tax will not apply to 14 essential items crucial for our livelihoods. Here is the list of goods that will remain tax-free:

- Rice & Grains

- Fish

- Fresh Milk

- Sago

- Spices

- Corn

- Fruits

- Soybeans

- Root Vegetables

- Eggs

- Meat

- Salt

- Sugar (from sugarcane)

- Vegetables

With this clarification, we can feel more at ease and not fret about potential price increases for basic necessities due to taxes. Our essential needs are safeguarded, allowing us to focus on more important matters.

Now, it’s time to share this accurate information with friends and family. Let’s ensure everyone knows that basic necessities will not be subject to a 1% value add tax! By spreading this information, we can help alleviate confusion and panic in the community. Thank you for reading, and don’t forget to stay updated with the latest information on Bukuku!

This article is based on written regulations: PERATURAN MENTERI KEUANGAN REPUBLIK INDONESIA

NOMOR 99/PMK.010/2020 TANGGAL 04 AGUSTUS 2020