Easy Way to Calculate Effective Monthly Rates Category A

Some people often feel that their salary runs out quickly because the tax deductions are too large. However, there is actually an easy way to check whether the income tax deductions imposed are appropriate or too large. Here’s the explanation!

Income tax deductions in Indonesia have several categories based on marital status and number of dependents. If you are single and have no dependents, then you are included in the effective monthly rate category A. Likewise for those who are married but do not have dependents, or who are single but have one dependent.

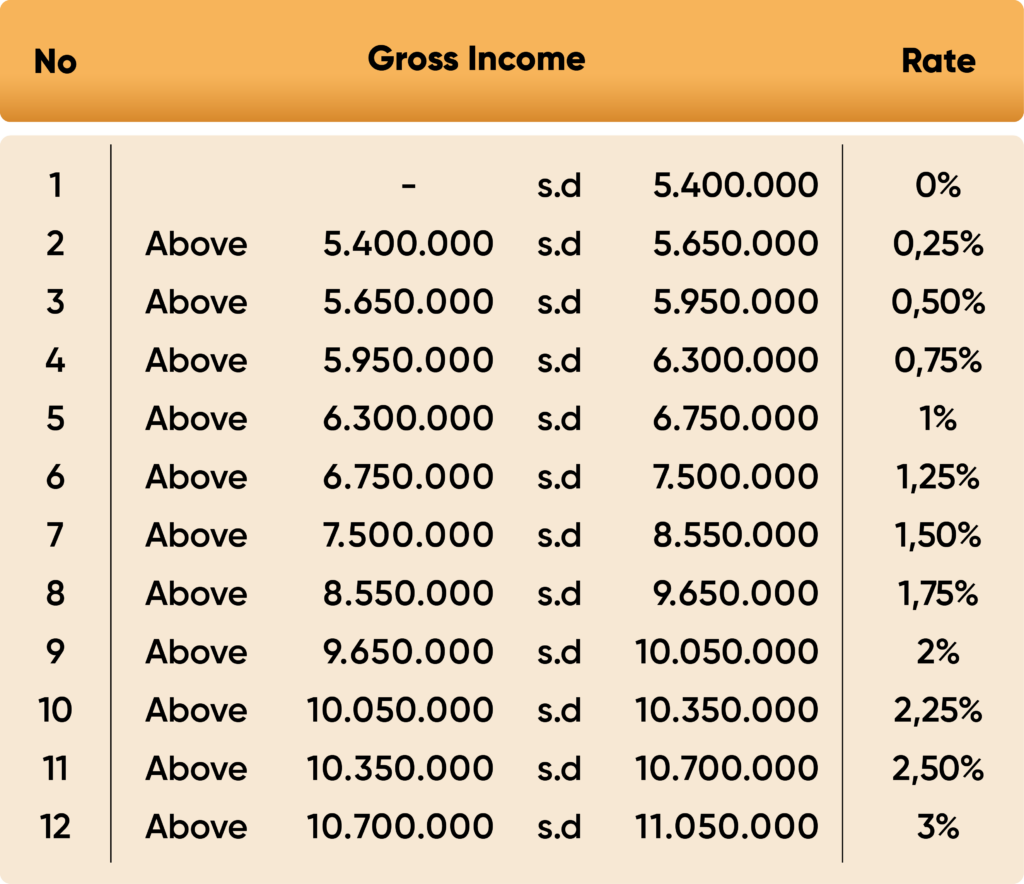

Table rate category A

For example, if your income is Rp5.5 million per month, then you can check the tax deductions in table A. In the second row of the table, the tax rate is 0.25%. This means that you only need to multiply your income, which is Rp5.5 million, by the tax rate.

The calculation of Income Tax (PPh) Article 21 deductions is as follows:

Gross income x rate according to category

5.500.000 x 0,25% = Rp13.750

So, the tax deduction imposed on income of Rp 5.5 million per month is only Rp13,750. That way, you can find out whether your salary is being drained due to this tax deduction or other factors.

If you still find it difficult to manage your finances or your salary runs out quickly, there may be other factors to consider, such as snacking habits or other expenses. So, before blaming taxes, try to check your overall expenses again.

This article is based on:

PERATURAN PEMERINTAH REPUBLIK INDONESIA NOMOR 58 TAHUN 2023, DATED 27 DECEMBER 2023

–––––

Bukuku Personal is a personal financial recording application equipped with Report, Budget, and Tax Calculation Features for Individuals & MSME. Download Bukuku Personal on Play Store or App Store.

Follow us for the latest news on financial and tax records through social media:

Instagram: @Bukukuapp

Facebook: BukukuApp

YouTube: @bukukuapp717