Easy Way to Calculate Effective Monthly Rates Category B

Many people may still not fully understand how to calculate the income tax deducted each month. There is a Ter B tax rate method that applies to those who are married and have one child. In addition, this tax rate method also applies to those of you who are unmarried but have 2 or 3 dependents, or for those who are married with 2 dependents, the same rate will also be imposed.

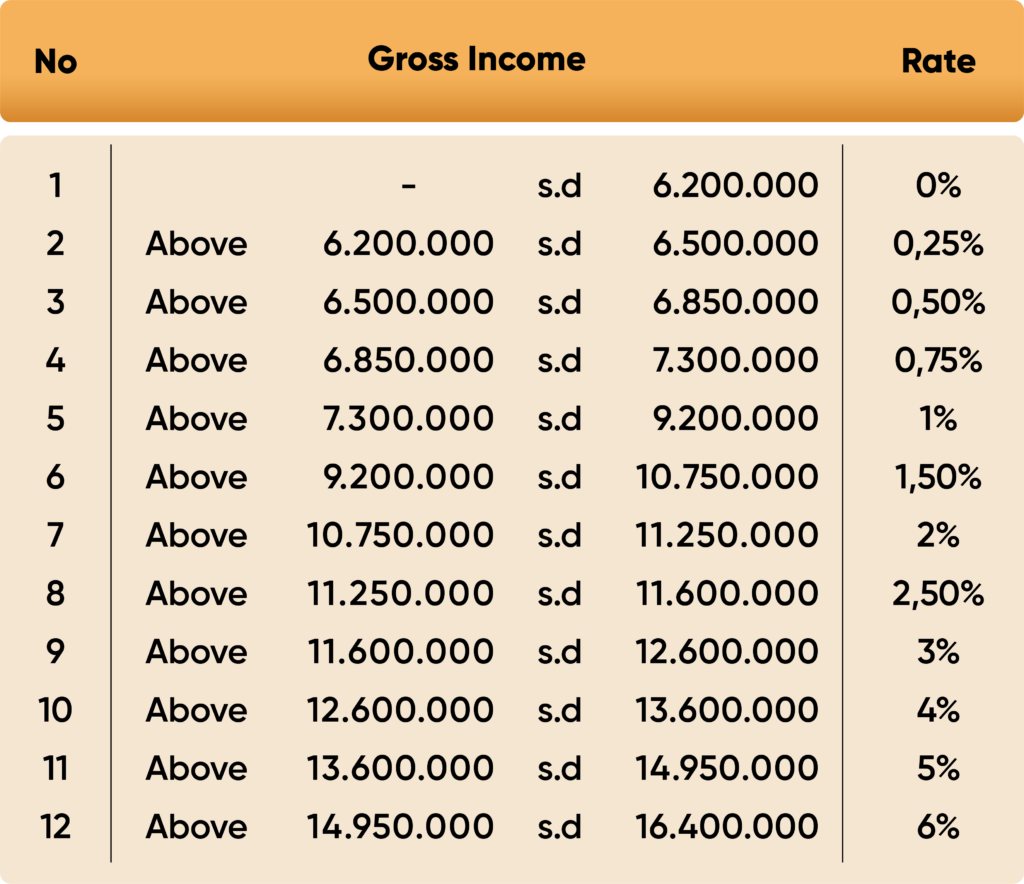

For example, you have an income of IDR 8 million per month. Based on the B rate table, for income between IDR 7.3 million and 9.2 million per month, the tax rate is 1%.

Table rate category B

The calculation of Income Tax (PPh) Article 21 deductions is as follows:

Gross income x rate according to category

8.000.000 x 1% = 80.000

So, the tax deduction imposed on income of Rp 8 million per month is only Rp 80,000.

This article is based on:

PERATURAN PEMERINTAH REPUBLIK INDONESIA NOMOR 58 TAHUN 2023, DATED 27 DECEMBER 2023

–––––

Bukuku Personal is a personal financial recording application equipped with Report, Budget, and Tax Calculation Features for Individuals & MSME. Download Bukuku Personal on Play Store or App Store.

Follow us for the latest news on financial and tax records through social media:

Instagram: @Bukukuapp

Facebook: BukukuApp

YouTube: @bukukuapp717