Recently, taxpayers have been talking about problems when accessing tax services on Coretax. As a result, taxpayers may experience delays in payment and reporting. The Directorate General of Taxes provides the elimination of administrative sanctions owed to taxpayers (WP) for: The elimination of this sanction is carried out as a relaxation in the Coretax transition […]

Latest Info: Update New Features in Coretax

Coretax DJP introduces the latest feature, namely Input Tax Credit in Different Tax Periods, max. 3 months The following is an example of an Example of Input Tax Invoice Credit for the 2024 Tax Period: Tax Invoices created in Coretax DJP starting from the January 2025 Tax Period can also be credited in a different […]

PKP Can Now Use the E-Faktur Client Desktop Application to Issue Tax Invoices

Taxable Entrepreneurs (PKP) can now issue tax invoices using the E-Faktur Client Desktop application following the issuance of Director General of Taxes Decision No. KEP-54/PJ/2025. This decision has been in effect since February 12, 2025. However, it is important to note that not all types of tax invoices can be issued through the E-Faktur Client […]

Easy Way to Report Annual Income Tax Returns Without Confusion

For most Taxpayers (WP), reporting the Annual Income Tax Return can be confusing. However, don’t worry! From now on, reporting the Annual Income Tax Return for 2024 and 2025 can be done in an easier and clearer way. Here is complete information on how to report the Annual Income Tax Return and the reporting deadline. […]

Changes to Pay and Deposit Taxes in 2025

Starting January 1, 2025, there will be changes related to tax payments & deposits. Based on the latest rules, taxes owed must be paid and deposited before the due date of the 15th of the following month. Taxes affected by this rule change include: With this change, don’t miss out on paying and depositing your […]

2024 Down Payment, How to Create a Settlement Invoice in Coretax?

Many of us make transactions with a term system. Please note, the term system is a method of payment in installments in buying and selling transactions. Then how do you make a Tax Invoice for a Settlement transaction in 2025 if the down payment transaction is in 2024? Due to changes in the application, the […]

Supporting Indonesian People to be Literate in Financial and Tax Recording, Bukuku Personal Application Receives #1 Most Recommended Award from Indonesia Award Magazine 2025

Nonih as Commissioner of PT Bukuku Solusi Kreatif received the certificate of #1 Most Recommended Tax & Finance Solutions Application for UMKM and Personal Award Winner 2025 from Indonesia Award Magazine 2025. As a appreciation in order to support the Indonesian people to be literate in financial and tax records, PT. Bukuku Solusi Kreatif through […]

Differences in Input Tax Before and During the Coretax Transition Period

Please note that there are different provisions regarding input tax before and during the Coretax transition period. Before Coretax, Input Tax that has not been credited with Output Tax in the same Tax Period, can be credited in the next Tax Period no later than 3 (three) Tax Periods after the end of the Tax […]

E-Faktur Desktop Reopened by DJP

E-Faktur Client Desktop and E-Faktur Host-to-Host applications can now be reused by Certain Taxable Entrepreneurs (PKP) who create at least 10,000 (ten thousand) tax invoices per month. However, Certain PKP can still create tax invoices using the module in the taxpayer portal in the core tax administration system. With this policy, it is hoped that […]

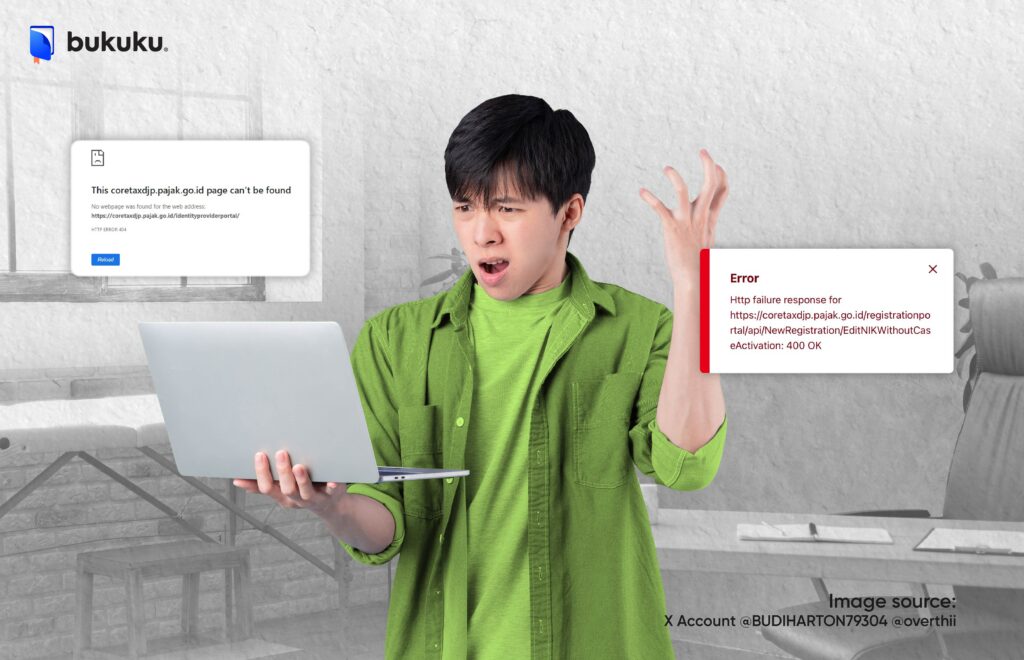

Coretax Often Experiences Obstacles, DJP Speaks Up About This

In connection with the transition period of Coretax DJP usage, there are obstacles that occur in the use of service features felt by Taxpayers. This causes inconvenience and delays in tax administration services. From the user or taxpayer’s side, there is concern that obstacles experienced during the process of accessing Coretax DJP will result in […]