Latest Info: Update New Features in Coretax

Coretax DJP introduces the latest feature, namely Input Tax Credit in Different Tax Periods, max. 3 months

The following is an example of an Example of Input Tax Invoice Credit for the 2024 Tax Period:

- For Input Tax in Tax Invoices for Tax Period October 2024, it can be credited to a different Tax Period in Tax Period January 2025

- For Input Tax in Tax Invoices for the November 2024 Tax Period, it can be credited to a different Tax Period in the January or February 2025 Tax Period.

- For Input Tax in the Tax Invoice for the December 2024 Tax Period, it can be credited to a different Tax Period in the January, February, or March 2025 Tax Period.

Tax Invoices created in Coretax DJP starting from the January 2025 Tax Period can also be credited in a different tax period.

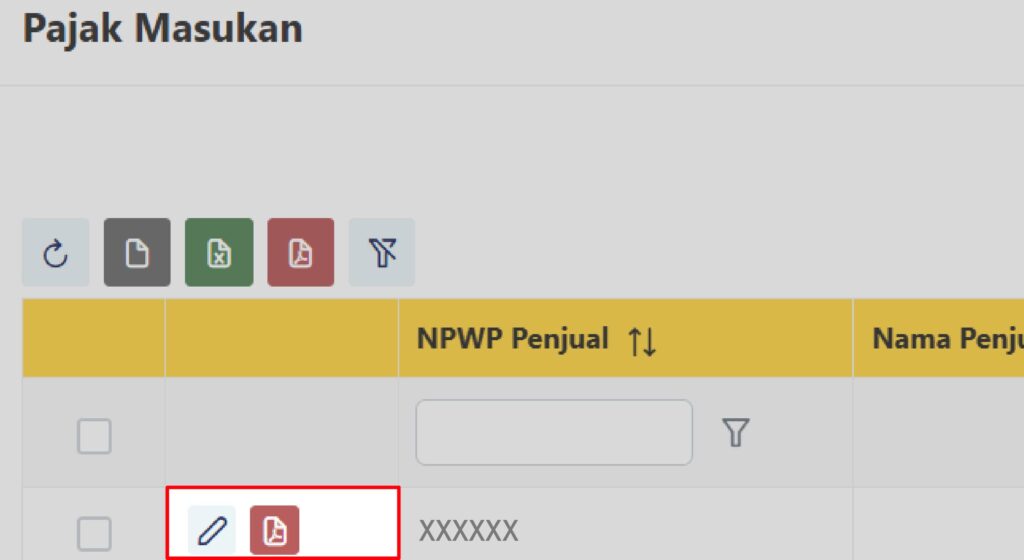

The location of Input Tax Invoice Crediting in Coretax can be found by clicking edit on the Input Tax Invoice.

Coretax Page View When Accessing Input Tax Invoice Crediting

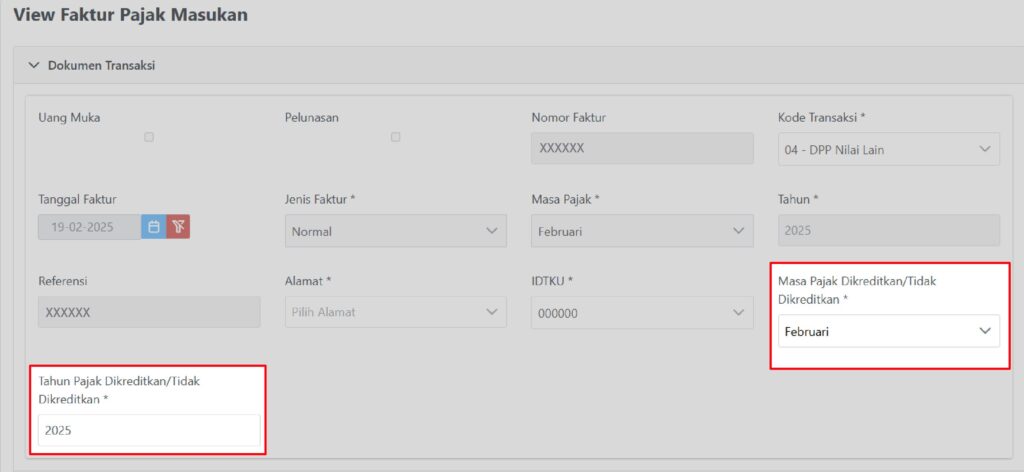

After entering the Input Tax Invoice View, select the crediting period.

Coretax Page View when opening Input Tax Invoice View

With this update, Coretax ensures ease in managing tax obligations for its users.

This article is based on:

INFORMASI TERKINI DITJENPAJAKRI, DATED 19 FEBRUARY 2025

KETERANGAN TERTULIS KT-08/2025, DATED 20 FEBRUARY 2025

–––––

Bukuku Personal is a personal financial recording application equipped with Report, Budget, and Tax Calculation Features for Individuals & MSME. Download Bukuku Personal on Play Store or App Store.

Follow us for the latest news on financial and tax records through social media:

Instagram: @Bukukuapp

Facebook: BukukuApp

YouTube: @bukukuapp717