Will Being an MLM Partner Be Taxed?

For those of you who are new to becoming MLM partners, you may have thought whether this profession will be taxed or not. However, you must first know how the tax perspective views MLM.

MLM partners are considered as distributors of multilevel marketing / direct sales companies and other similar activities. MLM partner income in the form of bonuses or sales commissions obtained from MLM companies will be deducted from Article 21 Income Tax with the calculation as non-employees.

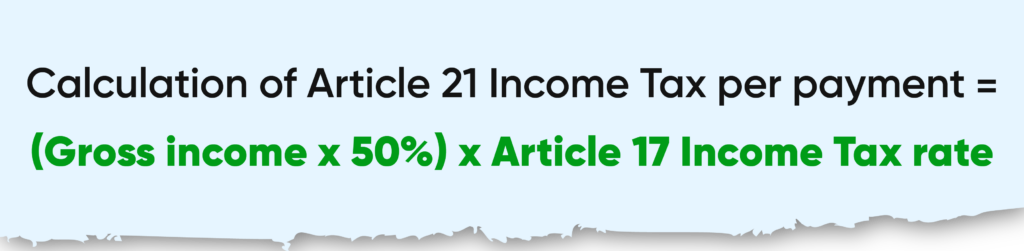

The tax calculation can be illustrated as follows:

On June 10, 2024, Mrs. A received a sales commission from an MLM business partner from PT ABC amounting to IDR 30.000.000, then the calculation is:

Article 21 Income Tax per June 2024 = (30.000.000 x 50%) x 5% = Rp 750.000

After fulfilling tax obligations, MLM partners are entitled to receive proof of Article 21 Income Tax deductions which are not final (Form 1721-VI) for each deduction made by the MLM company.

Through this explanation, hopefully you will better understand the tax provisions for MLM partners.

This article is based on: PERATURAN MENTERI KEUANGAN REPUBLIK INDONESIA NOMOR 168 TAHUN 2023, DATED 29 DECEMBER 2023

–––––

Bukuku Personal is a personal financial recording application equipped with Report, Budget, and Tax Calculation Features for Individuals & MSME. Download Bukuku Personal on Play Store or App Store.

Follow us for the latest news on financial and tax records through social media:

Instagram: @Bukukuapp

Facebook: BukukuApp

YouTube: @bukukuapp717