Are you part of the Sandwich Generation? Let’s Calculate the Monthly Effective Rate Category C

Many of us may often hear the term “Sandwich Generation” or even become a Sandwich Generation. Well, there is often a question, are we as the Sandwich Generation also taxed? It turns out the answer is yes. Then how is the calculation of the tax that we have to pay?

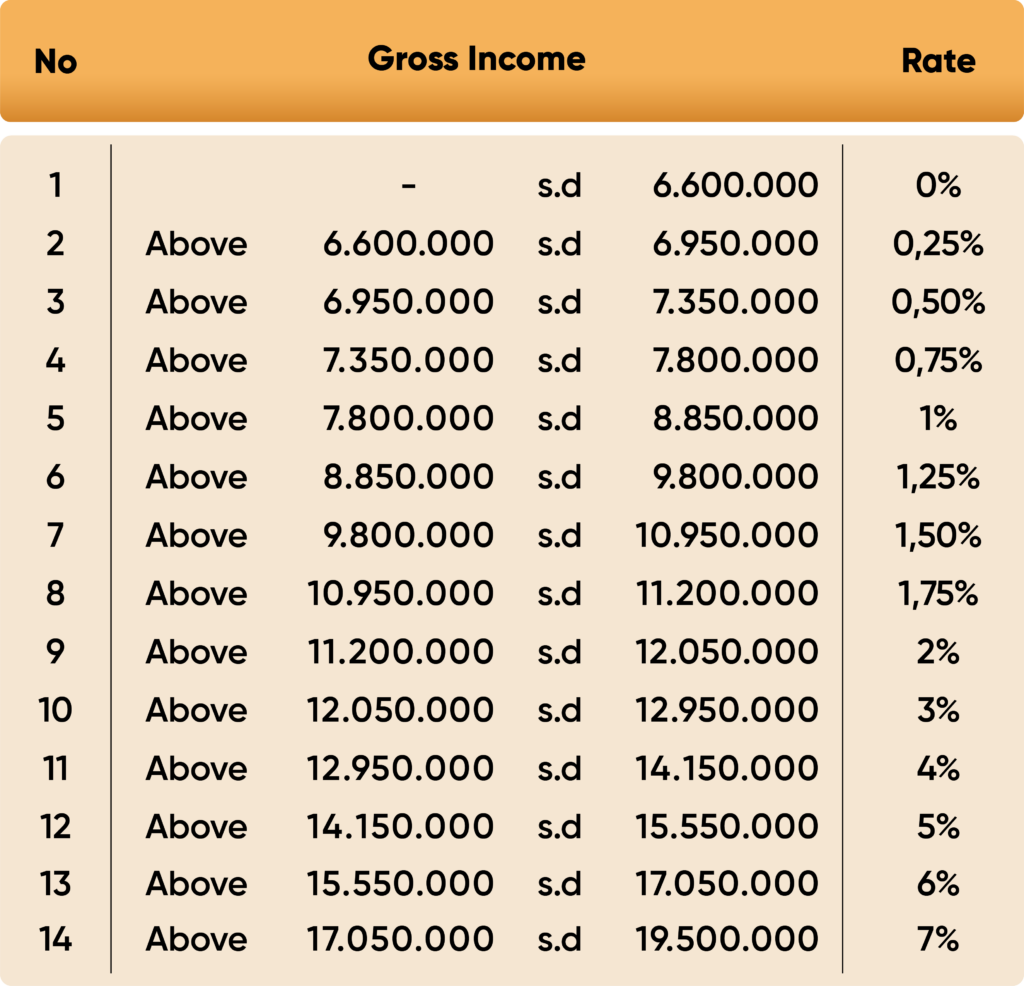

To make it easier to understand, let’s take an example of an individual with an income of Rp 15 million per month. Based on the C rate table, for income between Rp 14 million 150 thousand to 15 million 550 thousand per month, the tax rate is 5%.

Table rate category C

The calculation of Income Tax (PPh) Article 21 deductions is as follows:

Gross income x rate according to category

15.000.000 x 5% = 750.000

So, the tax deduction that must be paid every month is Rp 750.000.

Well, that’s an easy way to calculate income tax for Taxpayers who fall into the “sandwich generation” category. Of course, this information is very useful to help you manage your finances to be more controlled, especially in meeting tax obligations.

This article is based on: PERATURAN PEMERINTAH REPUBLIK INDONESIA NOMOR 58 TAHUN 2023, DATED 27 DECEMBER 2023

–––––

Bukuku Personal is a personal financial recording application equipped with Report, Budget, and Tax Calculation Features for Individuals & MSME. Download Bukuku Personal on Play Store or App Store.

Follow us for the latest news on financial and tax records through social media:

Instagram: @Bukukuapp

Facebook: BukukuApp

YouTube: @bukukuapp717